Medicare Supplemental Plans

Posted: July 07, 2022

Medigap Plans: A, B, C, D, F, G, K, L, M, N – Find Higher Quality Care and More Options

With Medicare Supplemental coverage there is No Network. That means you can go to any provider in the country as long as they take Medicare.

If you are eligible for Medicare, you get what is called Original Medicare, Parts A and B Benefits. The Part A Benefit covers in-patient hospitalization and the Part B Benefit covers out-patient doctor visits. However, you have minimal coverage and no out-of-pocket maximum. That means there is no limit to your potential health care costs.

So, most people will add a Medicare Advantage Plan or a Supplemental Plan to fill in the gaps in coverage that are left by the Part A and Part B benefits. Thus, these supplemental plans are often called Medigap plans.

Medication expenses are not covered on these plans. For prescription drugs, you would need to add a Medicare Part D benefit (or choose Medicare Advantage). Be careful not to confuse the Part D drug coverage with the Supplemental D health coverage.

What Supplement Plans are available?

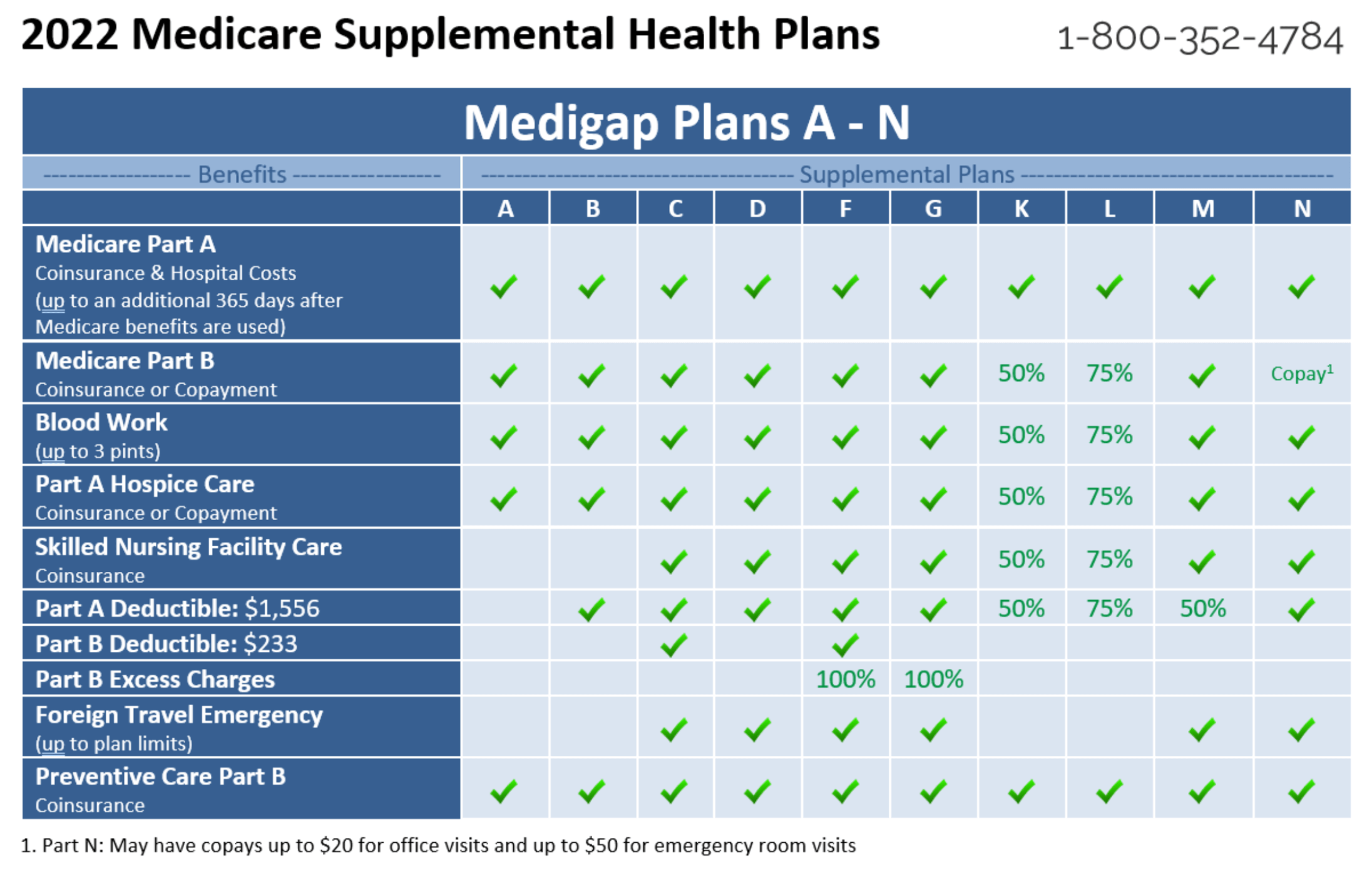

Original Medicare Benefits A and B are already included. Be careful not to get these confused with the Supplemental Plans A and B, which are different. The supplement plans (A, B, C, D, F, G, K, L, M, N), also known as Medigap Plans, fill in the gaps left by Original Medicare.

People choose the Supplemental Plans because they give them more flexibility and control. There are more providers available and more options for treatments.

Medigap Plans include the following:

A – This minimal coverage plan adds blood work coverage as well as hospice coinsurance/copayments.

B – This is the same as A, except that it also pays for the A deductible ($1,556 in 2022).

C – In general, C is not available to people born in 1955 or later. Younger people may have gotten this Medigap Plan if they received Medicare earlier due to a disability. This is a fairly comprehensive plan, just a step down from F and G. It includes all the Medicare supplemental benefits with one exception. It does not pay for the excess doctor fees that are not covered by the Medicare B Benefit.

D – This supplemental health plan covers all the Medicare supplemental benefits, with the exception of the Medicare B deductible and excess charges.

F – This insurance plan has the most coverage but it is not currently available. In general, F is not available to people born in 1955 or later (younger persons may have gotten this Medigap coverage if they received Medicare earlier due to a disability).

G – This Medicare insurance coverage offers the highest level of benefits currently available. We recommend G over C and F. F often costs $30 or more per month, when compared to G. And, the only difference is that G doesn’t pay for the B Benefit deducible ($233 in 2022). If a doctor charges an excess fee, that is covered by G.

K & L – These plans cover a percentage of the gaps in Original Medicare coverage. K covers 50% and L covers 75%. They do not include B deductible or excess charges, and they do not include Foreign Travel Emergency.

M – This medical coverage is the same as D, except for the fact that it only pays for 50% of the A Benefit Deductible ($1,556 in 2022). It does not cover the B deductible or excess charges.

N – This supplemental insurance plan is the same as D, except for the B Benefit where it includes a $20 copay for office visits and a $50 copay for emergency room visits.

Why are F and G the most popular?

People looking for Medicare Supplement Plans are usually wanting a higher level of health care coverage. F is the most comprehensive plan, but you will usually save a little money by going with G, which is the next most comprehensive plan and has a good price point. The cost for G is often not much more than the next level down.

Other Things to Note About the Supplemental Plans

K and A offer the least coverage. They tend to have the lowest monthly premiums.

N is the next best seller after G and F. N has good coverage, but you do have to pay a copay for doctor and emergency visits. If a doctor charges an excess fee, that is not covered by N. For many consumers, the decision comes down to the choice between F, G and N. How these three are priced in your area, will help you determine which is best for you.

Be aware that you cannot to have more than one Medigap Plan. For instance, if you choose G, you can’t also have C. However, it would not make sense financially to have two supplemental plans anyway. You would be paying extra premium for duplicated coverage.

Medicare Advantage Benefit C is considered a full coverage plan. You cannot add (to an Advantage Plan) the D Prescription Drug Benefit or any of the supplemental plans.