Medicare 101

Posted: July 07, 2022

3 Easy Steps to Getting Health Insurance Coverage for Seniors and for Individuals with Disabilities

If you are eligible for a senior health insurance plan or you are an eligible disabled person, you can enroll during specified election periods. Continue reading for information on Medicare Plans, prescription drugs, penalties, and enrollment periods.

Getting on Medicare is like building a house. The foundation is Original Medicare Parts A and B. Then, you build the walls by choosing either Medicare Advantage Part C or a Supplemental Plan. Medications are like the roof; you add them on at the end. If you choose Part C, usually Part D Prescription drug coverage is included. If you choose a Supplemental Plan, then you’ll need to add Part D.

1. The Foundation: Original Medicare Parts A and B

On July 30, 1965 President Lyndon B. Johnson signed into law Social Security Amendments called the Medicare and Medicaid Act. Since then, eligible seniors and disabled persons have been able to get Original Medicare Parts A and B. These are the foundation of Medicare health insurance coverage.

Part A is for hospitalization and covers the hospital room. Part B is for office visits. Part B also includes x-rays, emergency, ambulance, IV medications, labs, MRI’s, and EKG’s.

2. The Walls: Choose Either Medicare Advantage or Supplemental Plans

Once you have elected Original Medicare through the Social Security Administration, then you will want to add Medicare Advantage or a Supplement Plan to have more robust coverage.

Medicare Advantage Part C is the least expensive. It includes Part A and B, and it usually also includes Part D Prescription Drug Coverage. Medicare Advantage is usually HMO coverage. Also, you are more limited in physician options and procedures. That’s why the monthly premiums tend to be lower on Medicare Advantage as opposed to the Supplemental Plans.

Medicare Supplemental Plans include Parts A, B, C, D, F, G, K, L, M, N. These plans offer additional coverage that may be added to Original Medicare. Plans F and G are the most popular, and they offer the richest benefits. There are no doctor networks, so you can go to any physicians who accept Medicare. Also, these plans tend to cover more expensive procedures and offer more high-end PPO coverage. They do not include prescription drugs, so if you enroll in a supplemental plan, then you will also want to add Part D drug coverage.

3. The Roof: Add Part D Prescription Drug Coverage

You can add Part D Prescription Drug Coverage on top of a supplemental plan or on top of Medicare Advantage (if Part C does not include medications). You must have “creditable drug coverage” (at least as good as Medicare drug coverage) or be on a Part D plan in order to avoid the penalty for not having prescription drug coverage.

Most Part D Plans have a deductible and a 5 tier system. And, these plans have three phases of coverage: the advertised phase, the coverage gap (or doughnut hole), and the catastrophic coverage phase. However, these plans do not have an out-of-pocket maximum. They offer discounted coverage, but there is no limit to how much you might pay for prescriptions drugs. For this reason, some people elect to stay on their employer-sponsored coverage, which has an OOP Max that applies to medications.

Should I stay on my employer coverage instead of Medicare?

You may have the options to switch to Medicare, stay on your employer plan, or have double coverage. Depending on the number of employees at your work, Medicare may pay first or second. If you are taking expensive prescription drugs and are able to maintain employer-sponsored coverage, then it may be to your advantage to do so. The size of your employer group plan makes a difference:

- Employer Groups of Less than 20 Employees: You may continue on your employer-sponsored plan as secondary coverage. If you do, your Medicare coverage will pay first. If you choose not to enroll in Original Medicare Parts A and B, your employer-sponsored coverage may have additional limitations for members who are Medicare eligible and may stop covering certain health care benefits that you had been receiving before.

- Employer Groups of More than 20 Employees: You may maintain your employer-sponsored coverage and not enroll in Medicare. Or, you may add Medicare as a secondary coverage. In this case, your employer-sponsored coverage would pay first.

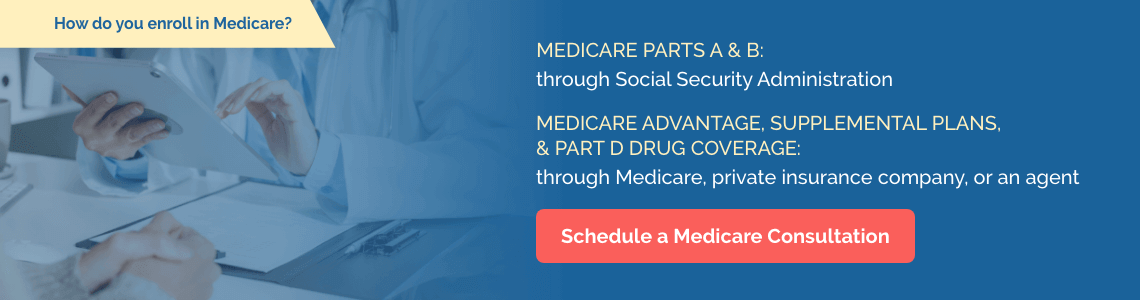

How do you enroll in Medicare?

For Original Medicare Parts A and B, you would enroll through the Social Security Administration. For Medicare Advantage, Supplemental Plans, and the Part D Drug Coverage, click here to shop and compare plans. You can enroll through Medicare, a private insurance company, or through an agent

When can you enroll in Medicare?

You can enroll in Medicare during your 7-month Initial Enrollment Period (IEP) or each year during the Annual Enrollment Period (AEP).

- Initial Enrollment Period (7 months): For seniors, this begins 3 months before your birthday month and continues to 3 months after your birthday month. For individuals with disabilities, this begins 3 months before your 25th month of receiving disability payments and continues to 3 months after.