Medicare Part D: Prescription Drug Coverage

Posted: July 07, 2022

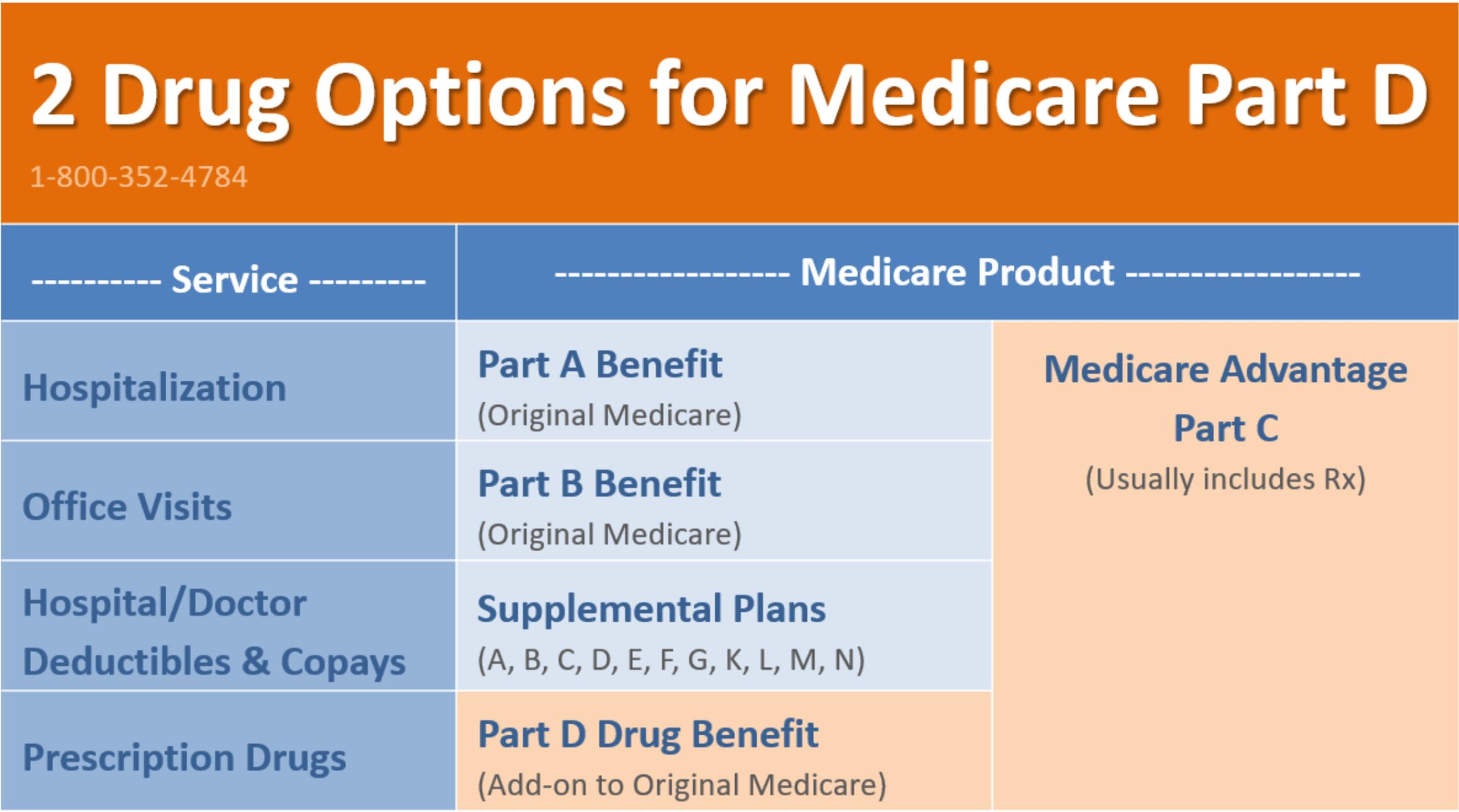

The Part D Rx benefit is embedded in Medicare Advantage, or it can be added (along with a supplement plan) to original Medicare (Parts A and B). You must live in the service area, and you must be enrolled in Part A and/or Part B to be eligible. Part D only covers out-patient prescription drugs.

Medicare Advantage Part C usually includes prescription drug coverage. If you choose to go with a Supplement Plan or if your Part C does not include Rx, then you can add a stand-alone Part D prescription drug plan.

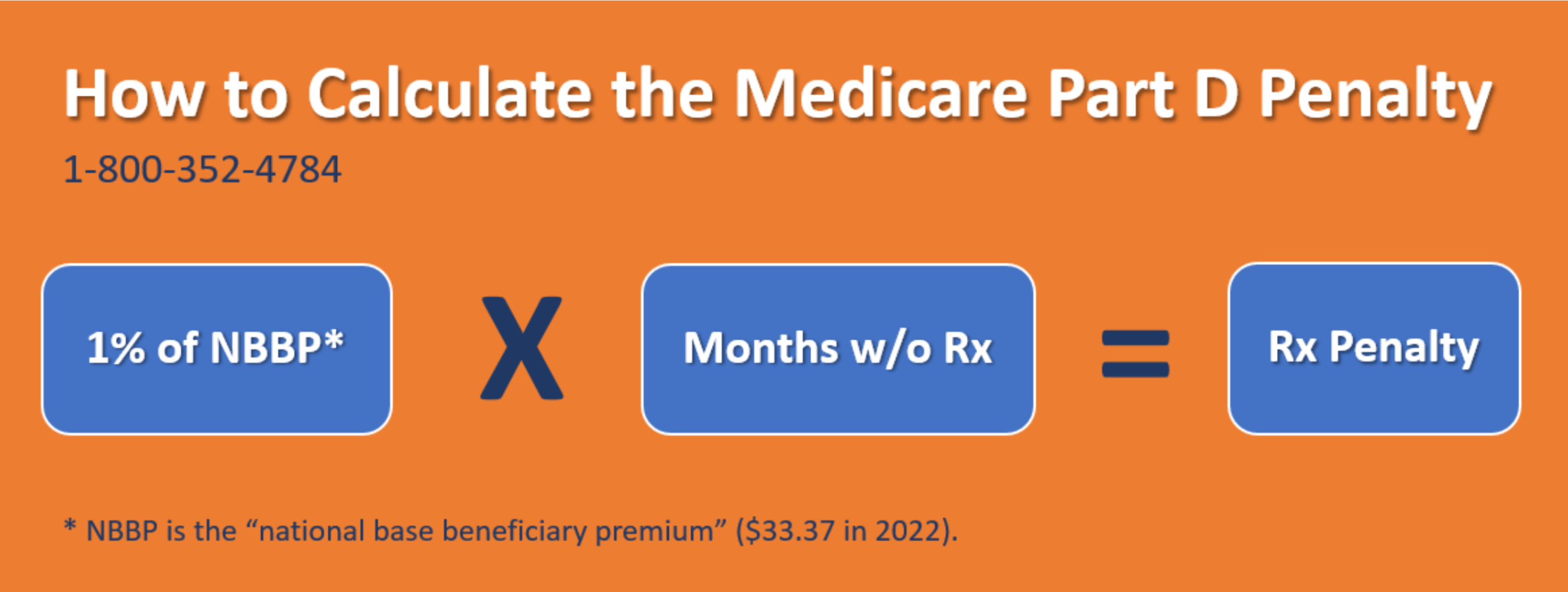

Avoid the Part D Penalty

During your Initial Enrollment Period*, you must get on a prescription drug plan in order to avoid the penalty unless your current employer plan has creditable drug coverage**. The penalty for not having Part D is 1% of the national average premium ($33.37 in 2022) multiplied by the number of full months that you went without coverage for your medications.

Once you have been penalized, you will continue to pay that additional penalty fee as long as you have Part D coverage. At age 65, if you are not currently taking medications, we would recommend to at least purchase the least expensive Part D Plan to avoid the penalty.

* The “Initial Enrollment Period” is the 7-month period beginning 3 months before your 65th birthday month (for seniors) or 3 months before your 25th month of disability payments (for those with disabilities).

** “Creditable drug coverage” is prescription coverage that is at least as good as Medicare provides.

How to Enroll in a Medicare Drug Plan

For Original Medicare, you enroll through the Social Security Administration, but for Part D you enroll through an agent or a private health insurance carrier in the state where you live. There are no health questions asked on the application, and you are eligible if you are enrolling through a valid enrollment period.

You can enroll during your Initial Enrollment Period or during the Annual Enrollment Period (AEP) each year, which is from October 15 – December 7. Click here to Shop and Compare Medicare Plans.

The Deductible

Most Part D options have deductibles. However, the deductible often does not apply to Tier 1 medications. On some Part D plans, tier 2 drugs are also covered before the deductible.

After you reach your deductible, you will often have a copay for your prescriptions.

Medications from Tiers 4 and 5

For these more expensive drugs from Tiers 4 and 5, you will often pay a coinsurance percentage. For example, you might pay 30% of the cost of the drug. Then, the health insurance carrier would cover the remaining 70% of the cost.

Tier 6 Drugs

Most Part D Plans are on a 5 Tier system. However, some health plans have a sixth tier where they offer certain medications at a reduced cost. Tier 6 prescriptions might include weight loss, hair loss meds, Viagra, or drugs for certain specific medical conditions.

If the Part D coverage is designed with certain health conditions in mind, medications related to those conditions might be included in Tier 6. For example, the plan might be focused on those with heart conditions, cancer, or diabetes. And, Tier 6 may include discounted drugs related to those medical conditions. Tier 6 is often not subject to the coverage gap (otherwise known as the “doughnut hole”).

No OOP Max on Part D

This is arguably the biggest drawback to Medicare. Medications do not add toward an out-of-pocket maximum. Therefore, there is essentially no limit to how much a Part D member could pay for prescription drugs. For this reason, some seniors at 65 elect to stay on health insurance coverage through their employer. Be aware that staying on employer-sponsored coverage may or may not be an option for you and certain restrictions do apply.

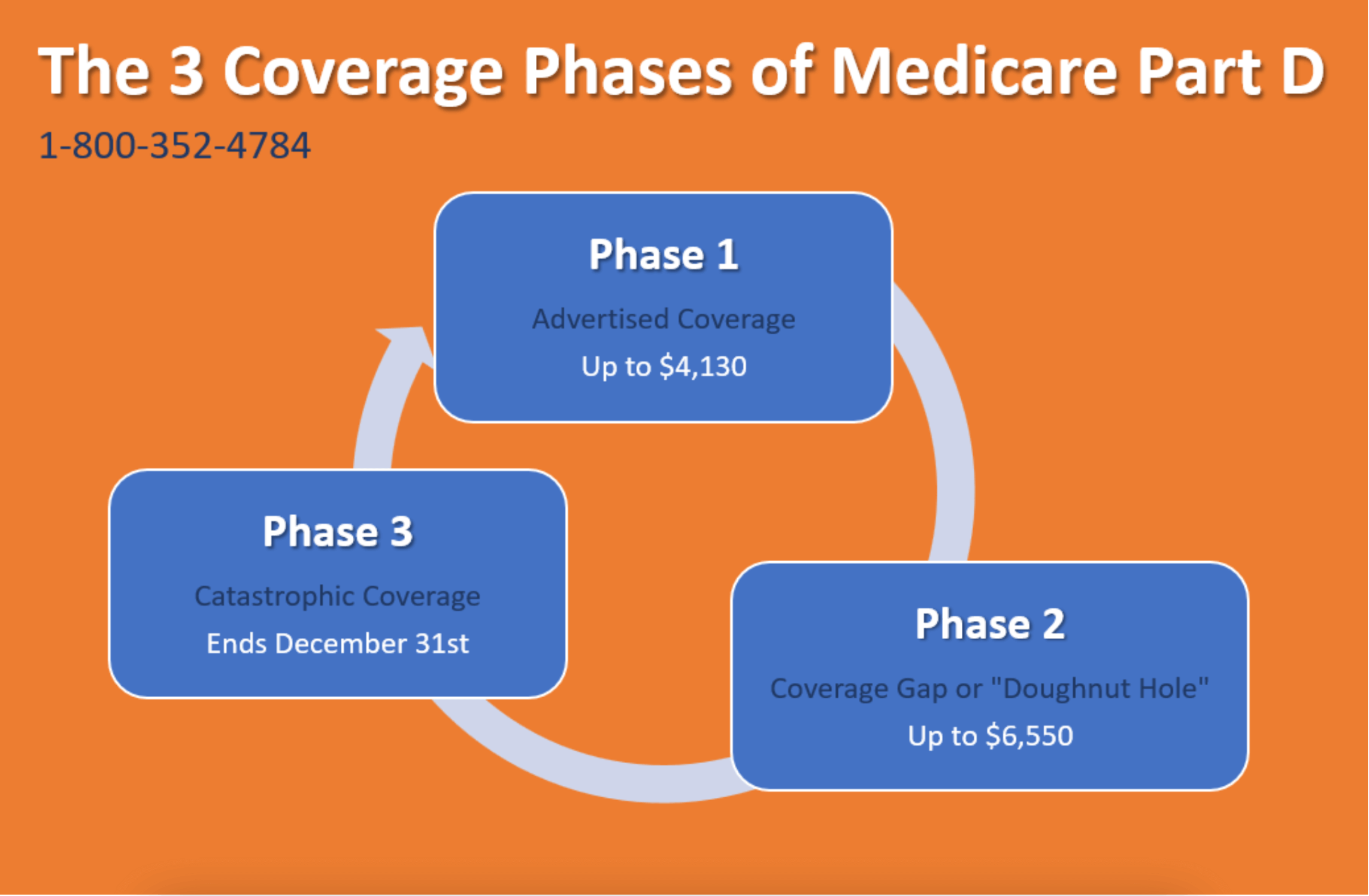

Coverage Phases

Drug benefits through Part D or Medicare Advantage Plans have Coverage Phases. These are periods of time where the coverage changes.

- Phase 1: Advertised Coverage

These advertised deductibles, copays, and percentages continue until you have used a cumulative total of $4,130 worth of medications (paid out by the consumer and the health plan).

- Phase 2: “Coverage Gap” or Doughnut Hole

You pay 25% of the cost of your meds. Some plans cover some drug tiers through the doughnut hole, but those are exceptions to the general rule. This continues until you have used a cumulative total of $6,550 worth of prescription medications (paid out by the consumer and health plan).

- Phase 3: “Catastrophic Coverage”

For generic drugs, you pay the greater of 5% or $3.70. For brand name medications, you pay the greater of 5% or $9.20. This continues through December 31 each year. On January 1, the whole process starts over, and you return to Phase 1.