Best Health Insurance Options for Young Adults in California

Posted: December 28, 2022

Health insurance is an essential investment for people of all ages, but finding it is often confusing for young adults in their 20s. While you can stay on your parent’s insurance plan until age 26, many young adults cannot choose this option. Young adults should find an alternative insurance plan to stay medically and financially protected.

Read on to learn more about health insurance options for young adults in California.

The Importance of Health Insurance for Young Adults

Despite its importance, many young adults do not have health insurance. If you are young and healthy, it can be tempting to avoid it altogether in favor of not spending money on a monthly premium. In addition, fear about costs and confusion about available plans can prevent young adults from seeking insurance plans.

It is crucial to remember health insurance plays an important role in financial and physical health. Young adults should explore available plans to protect themselves against potential health-related incidents. These are some additional reasons behind health insurance’s importance:

1. It Helps You Manage Massive Medical Expenses

One of the most significant functions of health insurance is making health care more affordable. In case of sudden illness or injury, your insurance plan covers some of your medical costs. Without incurring these major expenses, you can avoid significant medical debts and protect your financial savings.

Insurance plans set out-of-pocket maximums, which limit the amount of spending you can reach in a year for your medical expenses. Once you reach the limit, your insurance will cover the remaining balance.

Health insurance can provide coverage for medical expenses like:

- Prescriptions: Prescribed medications are essential for many. They help millions manage pain and limit illness progression. Without the assistance of insurance, medications might become too expensive to manage along with other daily costs.

- Hospitalizations: Insurance can also assist with overnight hospital stays and surgeries. Numerous surgical procedures are essential for physical health. Your plan can help you manage emergency costs, such as emergency room trips.

- Mental health services: Many insurance plans provide coverage for mental health and substance use disorder services, like counseling and other behavioral treatments.

- Pregnancy and maternity care: Your health insurance can cover maternity and pregnancy expenses.

2. It Gives You Access to High-Quality Health Care

Enrolling in health insurance also provides you with consistent and high-quality health care. You can connect with a network of providers and take steps toward a healthier lifestyle. With access to regular care, you can improve your well-being and quality of life.

For example, health insurance can help you access preventative services like vaccinations and screenings. These resources prevent illness and help you identify diseases before they worsen. Health care covers preexisting conditions, qualifying you for benefits based on prior diagnoses, too.

3. It Provides Peace of Mind

With health coverage, you avoid fears about large medical debts with the knowledge your insurance will help you manage high costs. Insurance also provides reassurance of ongoing access to health care. You become a member of the health care system and can feel safe knowing you have a consistent source of support.

Insurance plans also supply you with medical records, documenting treatments and prescriptions. It often reduces the amount of manual paperwork when you visit new medical providers, easing the transition.

Overall, patients can feel more empowered to seek help when they feel supported by the health care system. They know they can ask for assistance with both routine and urgent care. The more involved patients become in their health care, the easier it becomes to maintain a healthy lifestyle.

Health Insurance Options for Young Adults Under 26

Once they decide to enroll in a health care plan, young adults can explore their various choices. You can remain on your parent’s insurance until you turn 26, but you may not be able to choose this option. Luckily, young adults in California have many alternatives for health care.

Here is a closer look at insurance health care for young adults in California:

1. Choose Student Health Insurance

If you are enrolled in a college or university, you might be able to sign up for the school’s student health plan or insurance. These plans are designed to match the typical financial needs of students, so the premiums are often lower.

Student health insurance might be especially beneficial if you are studying in a different state. Sometimes, parental coverage can be limited by different state locations, making students ineligible. By choosing a student health insurance plan, you can still maintain insurance.

To get started with a student health insurance plan, contact your school’s financial aid office. Staff can help you learn about plan details and average costs. Some plans might not offer full coverage for maternity care or studying abroad, so it is important to research them first.

2. Enroll in an Employer’s Plan

Another option for young adult health insurance is to join an employer’s plan. This choice can simplify many of your decisions. For example, your employer often splits premium costs with you, lowering your monthly costs. In addition, you avoid the necessity of researching and finding a plan on your own.

However, there are a few exceptions for employer insurance, including:

- Missing the enrollment period: After your initial hiring, your employer should explain your health benefits and provide an enrollment period length. If you miss this enrollment period, you might be unable to join the plan until the next Open Enrollment Period.

- Contracted employees: If you were hired as an independent contractor, you might not have the choice of employer health insurance. It is best to check with your HR department to understand available insurance plans.

- Small business employees: Small business owners might not be required to provide health insurance for employees. If a company has 50 employees or fewer, they typically do not have to offer insurance. You might encounter this issue if you work for a small business.

3. Buy a Plan From a State or Federal Marketplace

If you are not enrolled in school or cannot access employer coverage, you can purchase a plan from a state or governmental marketplace. Young adults in the United States are eligible for plans as long as they register during the Open Enrollment Period. The deadline is typically toward the beginning of the calendar year in January.

You can use online federal databases to explore available plans and expected costs or use state-based resources to find insurance plans for your specific state. There are typically four major categories of health insurance plans in the Marketplace. They are based on how you split the cost with your provider. All plans provide free preventative care.

Here is a closer look at the four options:

- Bronze: Bronze plans have the lowest monthly premiums. You can access standard check-ups and preventative care with minimal costs. However, meeting with specialists or accessing more attentive care will cost higher.

- Silver: A Silver health insurance plan costs slightly more each month than a Bronze one. Silver plans have moderate costs for monthly costs and specialized care, making them a strong middle option.

- Gold: Gold plans have high monthly premiums. When you access preventative and specialized care, you pay much lower amounts. It also has an out-of-pocket maximum limit for medical expenses.

- Platinum: Platinum plans have the highest premium rates but the lowest deductibles for care. People typically choose Platinum options if they require frequent health care services.

You can always contact insurance specialists and other resources to learn more about available plans. Specialists can answer questions about plan differences and recommend plans based on your circumstances.

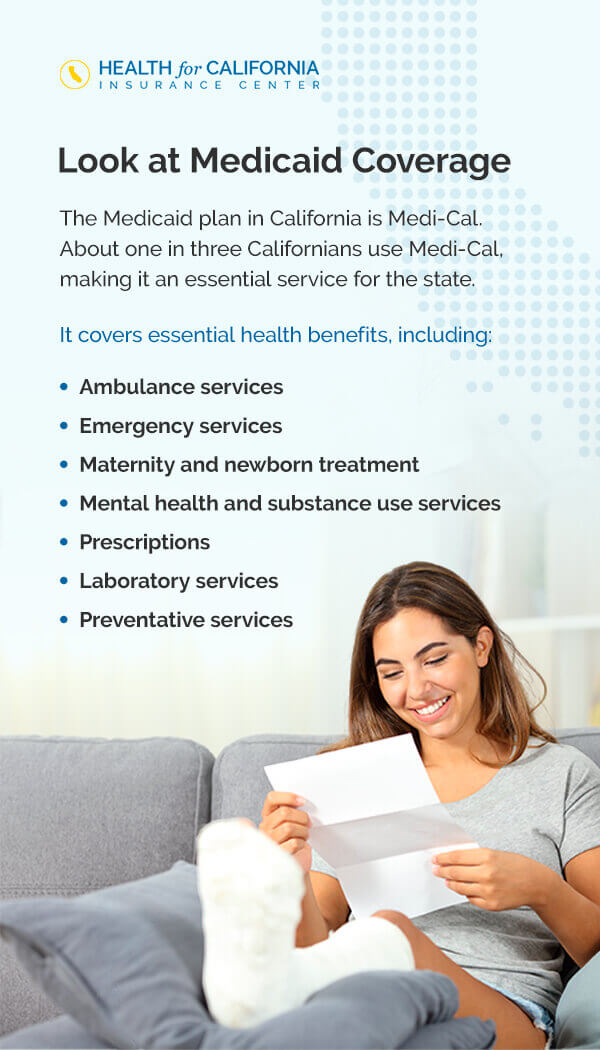

4. Look at Medicaid Coverage

Young adults can also research their eligibility for Medicaid coverage. Depending on your income and health circumstances, your state’s Medicaid plan might provide coverage.

The Medicaid plan in California is Medi-Cal. About one in three Californians use Medi-Cal, making it an essential service for the state. It covers essential health benefits, including:

- Ambulance services

- Emergency services

- Maternity and newborn treatment

- Mental health and substance use services

- Prescriptions

- Laboratory services

- Preventative services

If you meet the California Medicaid requirements, you can apply for a plan. You will need this information to fill out the application:

- Social Security numbers of all family members who need insurance

- Employment details of all employed family members who need insurance

- Federal tax information

- Other health insurance records on file

The application also asks basic questions about your address, citizenship, income and other demographics. Once it is processed and approved, you can select the best plan for your needs.

5. Try a Catastrophic Insurance Plan

Another option for young adult health insurance is a Catastrophic plan. These plans focus on the worst-case scenarios, such as serious injuries or illnesses. People under 30 are eligible to purchase this plan type.

Here are other features of Catastrophic insurance plans:

- Cost: Catastrophic plans have low monthly premiums but high deductibles. In other words, you will have to pay a significant cost for most services before the plan provides coverage. Once you spend the deductible amount, your plan pays for all covered services. Catastrophic plans are not eligible for additional financial help in the Marketplace, like some of the major four plan types.

- Coverage: These plans include the 10 essential health benefits, such as emergency services, preventative care and prescriptions. They also cover three primary care visits with your provider.

Catastrophic insurance plans are often tempting because of their low costs, but those with more urgent health care needs might not find adequate support from them. Remember that the plan does not provide coverage until you pay the deductible, which could result in significant expenses.

How to Compare Insurance Options

Choosing the best insurance option for your needs takes significant time and research. It is best to research plans as thoroughly as possible before enrolling in one. You should understand the eligibility requirements and financial obligations of plans, and make sure you can meet them.

These are a few other tips for comparing insurance options:

1. Research Your Options

Familiarize yourself with the available choices and compare them to your personal circumstances. One plan might suit someone perfectly but cause complications for others.

For example, a young adult who rarely visits the doctor could decide on a Catastrophic insurance plan, but someone with more urgent health care needs might not have enough coverage with that type.

Consider personal factors like:

- Health risk factors: Some people require more health care assistance than others. Those with chronic conditions likely need more specialized services and medications than those without them. Other lifestyle choices, like playing a sport or smoking, can also affect the level of regular health care you require. Consider how your lifestyle might require a more comprehensive plan.

- Financial situation: You should also consider your available budget while researching options. Determine a monthly spending amount you feel comfortable with, and use it to narrow down available choices.

2. Study Eligibility Rules

Another important element of finding insurance plans is verifying your eligibility. Each plan might have different criteria, including annual income or certain health conditions. If you do not meet these requirements, you will be unable to receive coverage. While you research available plans, look closely at eligibility needs.

3. Weigh Costs

Navigating insurance costs can be confusing, especially if it is your first time with them. Remember that premiums are the monthly rates that give you coverage. In addition, you might have to pay deductibles and co-payments.

As you research plans, compare premiums with out-of-pocket costs. It can be tempting to choose the least expensive plans with the lowest premiums, but they might lead to more out-of-pocket costs later.

For example, selecting the cheapest health insurance in California might cause you to pay higher service expenses. In other words, you might have to decide whether you want to pay more for the care or the coverage itself.

You can also work with insurance specialists to discuss your options and find the best payment options.

Contact Health for California for More Information

Health care is an important investment for young adults. If you are looking for California health insurance for young adults, Health for California can help you find the best option.

Our agents can explain available California health care plans and match you to the best option. We can guide you through the application process, explaining eligibility rules and all follow-up procedures. No matter your circumstances, you deserve access to high-quality and comprehensive coverage.

To get started with Health for California, contact us today.